Putting control of their money back into patients' hands @ Practi

Web App

Role | Design lead, working alongside my product manager and FE & BE engineers

Skills

Tools:

Figma

Wireframing

Prototyping

User research / User Interviews / Askable

Patients are waiting 3 years for NHS dental treatments, but aren't going through with them, why?

Cost of living means people might prioritise things other than dental care, even though dental care is extremely important and 3 years wait time is ridiculous, especially for urgent treatments

Conversely, our customers (dental practices) want to encourage patients to go through with the treatment.

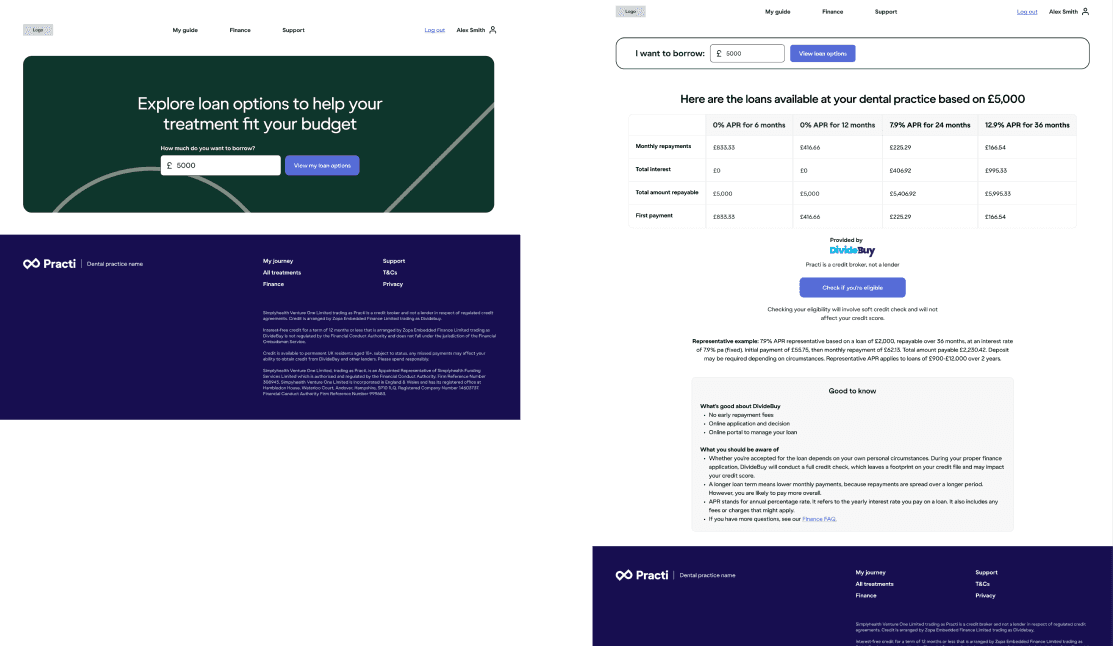

Currently, patients are unable to see how much a loan might cost them until the application

This could lead to

❌ Rejections and negative impact on credit score

❌ Decrease in trust with Practi

❌ Worst of all - bad reflection on their dentist (our customers)

So the opportunity, is how might we be help patients to go through with dental treatments via taking out a loan?

Constraints meant that a finance calculator wasn't the obvious answer

Finance calculators are a standard offering for most institutions but specific constraints we had to work within meant it wasn't the easiest path.

Internal constraints

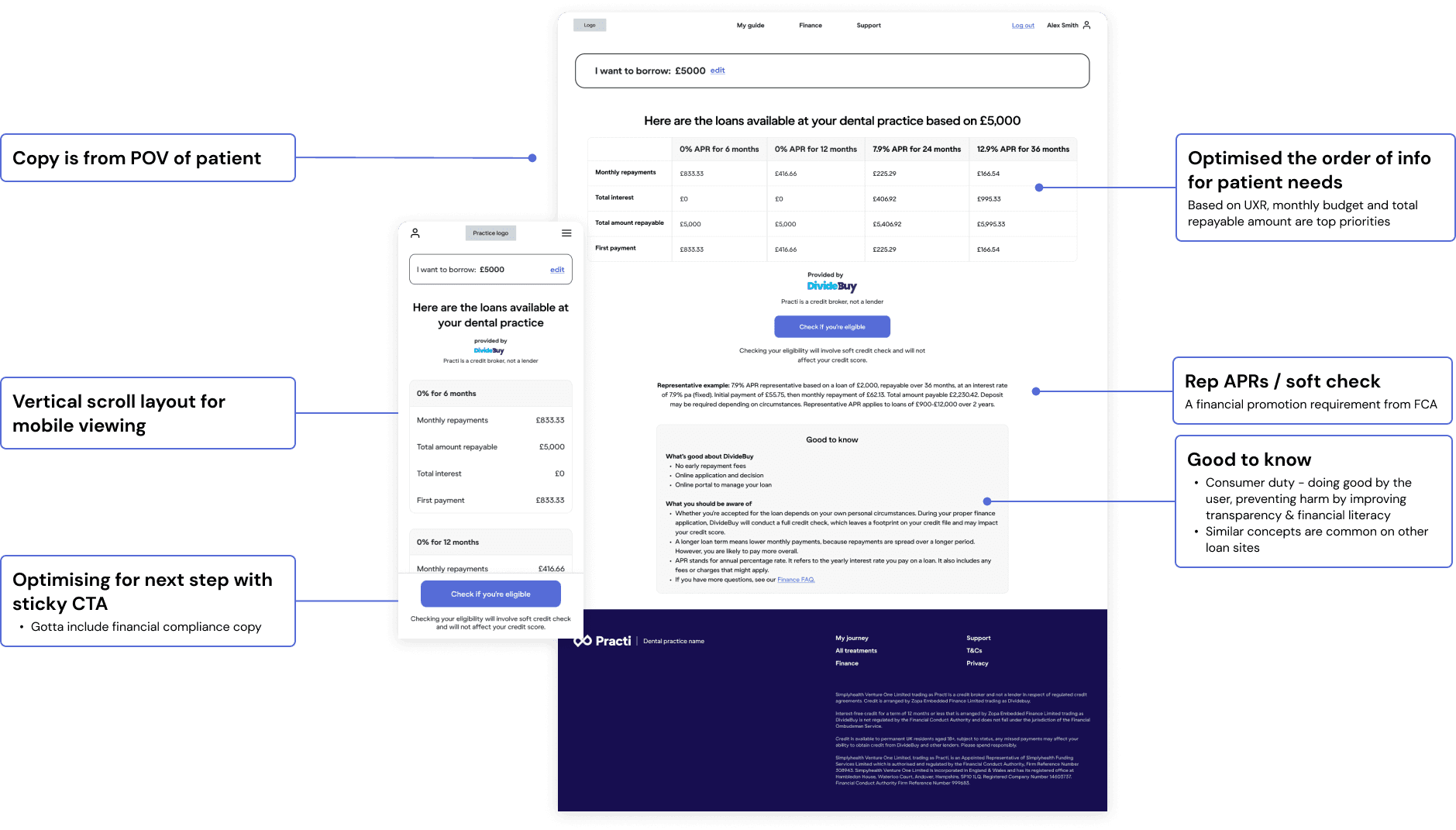

The loan calculator has to be able accessible from multiple points

This feature is very much a strategic stepping stone for the product’s direction so it had to be A) scalable and B) componentised to live in multiple locations

We have a set amount of loan options

Our loan calculator, effectively, is not really a calculator

Our dental practices offer between 1-4 options

Advantage: have more control of the layout since we don’t have infinite options

Lender constraints

We do not own the formula or data - Therefore, we cannot calculate by monthly budget because we don’t know the formula or compounding interest

Each loan has a min & max credit amount - This means that the patient cannot take out a loan if the treatment cost is outside of that range

Our hypothesis was that the solution should still work within a loan calculator mental model

IF we provide a loan calculator solution to the patients where they can enter the price of their treatment and get the approximate breakdown of the cost

THEN more patients will feel more in control of which loan they can apply for

AND accept the treatment

THEREFORE treatment conversion should increase

Mapping the IA, user & data flow to ensure every scenario is considered

Competitor analysis revealed our flow was unique due to constraints

This meant that relying on secondary research was not going to be enough.

Therefore, I conducted user interviews and created surveys with my PM to ascertain the most important factors for patients to consider taking out a loan.

The results

Lower monthly payments

Total cost of loan

Eligibility

Ease of comparison

Compliance was consulted throughout the process

It was essential for the unhappy path to be thoughtfully considered

Bad credit could damage a user's trust and eligibility, meaning potential unhappy paths had to be negated.

Key learnings

To us, it’s a loan calculator, to the user, it’s about keeping within budget and improving their health

In the current economic climate, improving our product’s user experience can significantly improve customers' emotional and financial well-being

Even though this feature seems to simply be a loan calculator, it’s key to just one part of the user’s journey in applying for credit and improving their overall health

Redefine success: working within constraints often produces a better result

There were lots of constraints, which felt impossible at first but forced me to think outside the box

It’s not a failure if it helps us learn

Look at the bigger picture. It’s a successful step in moving in direction of lead capture and unauthenticated access to Practi